Differences Between W9 and W8 Tax Forms

- 22 Jan 2024

- 11 mins read

- Posted in

Content

- First things first: What are your tax responsibilities as a business?

- Understanding the Purpose of W-9 Tax Forms

- Exploring W-8 Series Tax Forms

- The 5 types of W-8 Forms

- W-8 vs. W-9: Identifying the Key Differences

- Filing Requirements and Procedures

- Filing Deadlines

- 2024's New E-Filing Mandate

- Common mistakes and top tips for accurate completion

- Legal implications and penalties

- International Taxpayers and U.S. Tax Compliance

It’s tax season in the US! When it comes to managing taxes for employees, you may be on top of things already. You’ve followed a streamlined onboarding process. You’ve made the correct deductions all year. You’ve got this!

But what about tax compliance for freelancers and contractors? That’s where it often gets chaotic. Here’s the main reason – it’s common knowledge that independent contractors are supposed to file their own taxes. But employers sometimes take this to mean they have no responsibilities at all. But that’s not true.

You are still required to gather the right documentation and submit necessary declarations. In this handy guide, you’ll find all the information you need to get this right.

First things first: What are your tax responsibilities as a business?

As a business based in the US, you would need to track how much you have paid independent contractors within the country, over the last year. If that adds up to less than $600 per worker, you do not actually have any tax responsibilities.

But if that amount is more than $600 over the year, you’d have to report it to the IRS through the Form 1099-NEC (that’s why freelancers and contractors are also referred to as 1099 employees). You would need to fill out and submit this form to the IRS by 31st January – and send a copy of it to the freelancer.

While it is up to the worker to file and pay their own taxes, the IRS still needs this information from you so that they can verify that independent workers are paying taxes on the right amount.

In order for you to fulfill your responsibilities as a business, you would need your independent contractors’ details. That’s where the forms W9 and W8 come in.

Understanding the Purpose of W-9 Tax Forms

What are the W-9 Tax Forms used for?

Before you can submit the Form 1099-NEC for your independent contractors, you will need some crucial information from them – like their business name, their Taxpayer Identification Number (TIN) and more. The Form W-9 helps you collect this information. It is officially known as a ‘Request for Taxpayer Identification Number and Certification’.

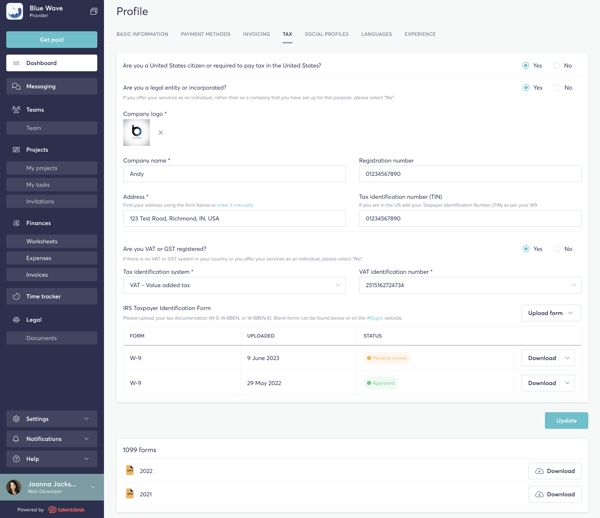

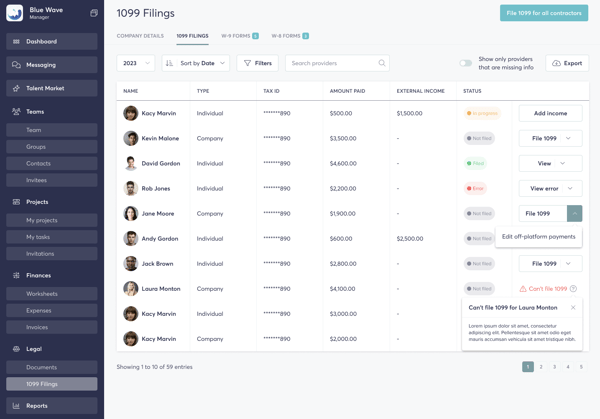

Since this is such a crucial form to have on file, some freelancer management systems like TalentDesk automate this process, collecting and storing this form right when onboarding freelancers.

Who should fill the W-9 Forms?

To clarify, you as the client are not required to fill the Form W-9. It would need to be filled by any US-based self-employed professional you work with, and submitted to you. This extends to workers who are citizens, non-citizen residents, as well as businesses – basically anyone with a Social Security Number or a TIN.

What information does the W-9 Form collect?

This form records all the information that is needed to correctly identify each worker. This includes their name, address, registered business name if any, their SSN or TIN, and of course, their signature.

Download the IRS W-9 Form here. ⬅️

Exploring W-8 Series Tax Forms

The W-8 Forms: An overview

So far, we have discussed situations in which you work with independent workers based in the US. But the beauty of the freelance economy is that you don’t have to stick to one geographic area – you can choose to work with top professionals from all over the world.

While the Form W-9 is relevant to US-based independent contractors, the W-8 forms are for those international, non US-based self-employed individuals and entities you work with.

The various types of W-8 forms and their purposes in the tax system

When you are working with international 1099 employees, you may need to withhold some amount as taxes for them. Typically, foreign entities are subject to 30% tax deductions when they work with US-based companies.

However, the US has tax treaties with different countries. If your international workers are from one of those nations, they may be entitled to some exemptions and not end up having to pay the full 30% in taxes.

That’s where the W-8 forms come in. These forms are used to identify the status of these workers as foreign citizens and record their base country, so that the right exemptions may be made.

This is not just a single form – there are actually five different kinds of W-8 forms available. Let us explore each of them to understand which one your freelancers will need to submit in different situations.

Download the IRS W-8BEN Form here. ⬅️

The 5 types of W-8 Forms

1. W-8 BEN

This is called the ‘Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting’ – it is the W-8 form that’s most commonly used. It records that the individual submitting it is a foreign national who is the owner of their business.

It documents details like the person’s name, address, identification numbers and more, as well as the country they are based in. Submitting these details allows the individual to claim the correct exemptions they are entitled to.

2. W-8 BEN-E

This is also called the ‘Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting’. But whereas the previous form applies to individuals, this one applies to foreign entities.

It records identifying details about the entity, including its registered name, its Foreign Account Tax Compliance Act (FATCA) status and more.

3. W-8 ECI

This is called the ‘Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States’.

When an individual engages in trade with a US-based business, and gets paid by them, their earnings are termed as ‘effectively connected income’. This means that even though they are based in a different country, the individual will be taxed at the same rate as US citizens – and not have to pay the usual 30% tax withholdings that a foreign national would be subjected to. In fact, if their country has a treaty with the US, they may even be eligible for further exemptions.

The Form W-8 ECI records these details so that the individual can make the right claims.

4. W-8 EXP

This is called the ‘Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting’. As the name suggests, it is to be filed by foreign government organizations and other tax-exempt foundations, in order to claim tax withholding exemptions.

5. W-8 IMY

Finally, we have the Form W-8 IMY. This is known as the ‘Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting’.

This is to be filed by entities that are acting as intermediaries or flow-through organizations for foreign individuals, and accepting income on their behalf. This includes entities like partnerships, trusts and more. This form records the status of the entity in question and the situation under which they are acting as the flow-through organization.

W-8 vs. W-9: Identifying the Key Differences

Who files the W-8 and W-9 forms

Form W-9 is only relevant for US-based self-employed workers – if they have an SSN or a TIN reference, they would need to submit this form to their clients within the country.

The W-8 forms are applicable for foreign nationals or entities who are earning an income from US-based businesses.

W-9 and W-8 form categories

The W-9 is just a single form. Any US-based self employed workers can fill and submit this, irrespective of other factors that affect their business.

The W-8 on the other hand, is a series of 5 forms. It is important that individual workers or entities identify which W-8 form is relevant for them, and file the right one.

The role of each form in tax compliance

The key function of the Form W-9 is to enable you, as the paying company, to have your contractors’ identifying information on record, so that you can report the amount you’ve paid them. The end goal of this is to help the IRS verify how much an independent contractor is earning, so that they can confirm that they are filing taxes on the accurate amount.

The W-8 forms help you record the status of the foreign individuals or entities you are contracting to, so that you can calculate the exemptions they are eligible for – and accordingly withhold the right amount when you pay them. It also helps the IRS track the amount that US companies are sending overseas.

Filing Requirements and Procedures:

Now that we are clear on who files each form and under what circumstances, let us move on to filing procedures.

When and how to collect W-8 and W-9 forms

The Form W-9 should ideally be collected right when you are onboarding your freelancers and contractors. Now, you may wonder at the need for this. After all, if you pay the worker less than $600 in the year, you will not have to submit a 1099-NEC for them – so why collect the W-9 form? The reason is that often, employers don’t know how much they’ll pay a freelancer or a contractor throughout the year. For example, if you end up loving the professional’s work, you may decide to engage them for projects beyond the initial scope.

If you end up paying them less than $600 that year after all, you don’t have to file the 1099-NEC for them. But it’s better to have the Form W-9 on record and not need it than to need it and realize that you don’t have it!

As for the W-8 forms, you will need to collect the relevant one before you make the first payment to a new foreign contractor. If you don’t receive it on time, you will need to deduct 30% as tax withholdings. Most employers prefer collecting this during onboarding, to simplify the process.

The submission process

The Form W-9 needs to be filled in by your US-based self employed workers and submitted to you. If there is a change in their name, address, or any other detail, they will be required to submit a fresh Form W-9. Do note – this is for your record-keeping purposes only, so do not submit this form to the IRS. Just ensure you store this securely for 4 years after the freelance engagement.

Likewise, the W-8 forms are to be submitted to you by your foreign workers or entities. Each form will be valid for the rest of that calendar year, as well as the next 3 years after that. Here again, this is for you to have on record, so it should not be submitted to the IRS.

Filing Deadlines

For companies in the United States, the deadline for filing 1099 forms is typically January 31st of the year following the tax year in question. This applies to certain types of 1099 forms, such as the 1099-NEC (Nonemployee Compensation), which must be filed with the IRS and provided to the recipient by this date.

However, for other types of 1099 forms, like the 1099-MISC (Miscellaneous Income), the deadline may differ. If you're filing forms other than the 1099-NEC, it's essential to check the specific deadlines for each form.

Regarding extensions, companies can request a 30-day extension to file their 1099 forms by submitting Form 8809, "Application for Extension of Time to File Information Returns," to the IRS. This form should be filed before the due date of the 1099s. It's important to note that this is an extension to file the forms with the IRS, not an extension to furnish the forms to the recipients. The recipients must still receive their copies of the 1099s by the original due date (typically January 31st).

2024's New E-Filing Mandate

As a business owner handling numerous contractors, it's crucial to stay informed about the latest tax laws to avoid penalties and reduce costs. Understanding tax compliance is essential to manage expenditures on independent contractors effectively and prevent financial risks. Tax season adds extra administrative work, distracting from strategic business areas.

The IRS and Treasury have introduced new tax-filing rules starting in 2024. Businesses filing over 10 returns a year must now do so electronically, including Forms 1099-NEC. This change is part of the IRS's effort to efficiently process the over 4 billion tax forms it receives yearly, including around 40 million paper submissions.

Key points of the IRS e-filing mandate:

- Businesses filing more than 10 returns annually are required to e-file.

- This includes various forms, such as W-2s, 1099s, partnership returns, and corporate income tax returns.

- The previous threshold was over 250 returns for each form type.

To comply, tally your total returns, including 1099-NEC forms for freelancers. The IRS's new Information Returns Intake System (IRIS) helps with e-filing, supporting different form types and volumes.

Exceptions to e-filing are limited, with potential waivers for compliance difficulties. Employment tax returns are exempt from this mandate. Non-compliance risks include rejected filings and penalties, reaching up to $310 per form, with a maximum annual penalty of around $1.2 million for small businesses.

Common mistakes and top tips for accurate completion

- Filing the wrong form. We have already discussed who needs to fill out which form. However, this can get confusing, especially with the W-8 forms. Filing the wrong form can render it invalid – and mean that the worker does not get the tax exemption they are applying for. That is why it is best to consult a professional if there’s any doubt.

- Incomplete information. Submitting an incomplete form could render it invalid as well. Whenever one of these tax forms is submitted to you, do ensure you check that all the relevant fields have been filled in.

- Invalid or incomplete signatures. The forms need to be authorized, signed and wherever needed, be complemented by supporting documents. For example, if a form is being signed through a Power of Attorney, the right documents will have to be provided to authenticate that. Ensure that your contractors don’t miss out on these key steps.

- Not checking the right boxes. The different forms have different, specific requirements that need to be kept in mind while filling them. For example, the capacity checkbox under the signature will need to be checked in Forms W-8 BEN-E, W-8 ECI and W-8 EXP. This may seem like a small detail, but it’s a necessary step – so some basic knowledge of these forms is crucial.

- Forms not collected in a timely manner. There’s nothing more stressful than trying to file your 1099 forms at the last minute, or trying to withhold the accurate amount as taxes – and realizing that you do not have all the necessary contractor information to do so. Do ensure you gather these forms during onboarding to avoid this.

Legal implications and penalties

So what happens if you miss collecting the W-9 or W-8 tax forms or they are invalid? Unfortunately, the fallouts of this can be quite serious.

- Financial implications for workers. This is especially true for your foreign contractors. A mis-filed Form W-8 may mean that they face 30% deductions, when they could have benefitted from exemptions. This may lead to conflict and soured relations.

- Civil or criminal charges. The worker in question can face $50 penalties for tax non-compliance. In fact, if the IRS sees such mistakes to be cases of deliberate neglect or falsification, these penalties can go up to $500, and can even lead to criminal or civil charges.

- Penalties for the paying company. Not having your workers’ W-8 or W-9 tax forms could mean you fail to file the 1099-NEC on time, or withhold the right amount as taxes. This can mean hefty fines for you. The fine for delayed 1099-NEC forms can be anything between $60 - $310 per form depending on how late you are. Again, intentional non-compliance would mean higher fines and charges.

- Audits by the IRS. If you are thought to be wilfully ignoring the tax protocols, it can open your business up to federal or IRS audits. This may cause irreparable damage to your company’s reputation and credibility.

International Taxpayers and U.S. Tax Compliance

How international taxpayers are affected by W-8 forms

For foreign individuals and entities contracting with US-based companies, filing and submitting the relevant Form W-8 is just one part of their tax obligations. It helps them claim the tax exemptions they are entitled to. However, as self-employed workers, they will still be responsible for filing and paying their own taxes, as applicable.

Taxpayer obligations under U.S. tax law

Similarly, US-based workers too, submitting Form W-9 is just one step of the process. They are required to file their annual tax returns, and pay the amount necessary. They are also responsible for keeping themselves updated about any changes in US tax laws, and follow the protocols applicable to them.

W8 and W9 tax forms: Tools for compliance

As an employer using the services of independent contractors, your W-9 or W-8 responsibilities may seem simple enough – collect the forms, ensure that they are complete, and then use the information there to file the Form 1099-NEC on time or carry out the right tax withholdings.

The process however, can get complicated as you start working with more freelancers and contractors. If you are handling these documentation processes manually, it is all too easy for something to slip through the cracks – one form left incomplete; one supporting certificate forgotten.

A software like TalentDesk assists you by automating this step. We customize your onboarding process to not only cater to your organization’s specific needs, but to also ensure that the right forms are collected, right at the start of each engagement.

We also make sure you do not have to worry about whether the previous manager remembered to collect the right forms, or whose inbox a particular document might be stored in. Our system stores all the documents securely in one place, in the Cloud, which keeps the process highly organized, and also ensures you meet all the required data protection laws and protocols.

All of this goes a long way in helping you make your freelancer engagements smoother – and make the tax season a lot more hassle-free!

Sanhita Mukherjee

Tags

Speak to us to find out how we can help you ensure compliance

Related articles

Compliance in Vendor Management

Ensure safe vendor partnerships with a third-party compliance strategy. Learn key regulations, audit steps and how TalentDesk simplifies vendor management.

Vendor Risk Management – How to Identify & Control Third-Party Risks

Proactive Vendor Risk Management is key to preventing compliance & financial issues. Learn how to assess, score and mitigate vendor risks effectively.

Contract Management in Vendor Relationships

Learn how to manage vendor contracts effectively, from key clauses and negotiation tips to lifecycle best practices that reduce risk and boost performance.

Understanding the ABC Test in Worker Classification

Navigate the complexities of worker classification with an understanding of the ABC Test. Explore its legal, financial, and compliance implications.

What is Freelancer Compliance? A Complete Guide for Businesses

Discover what freelancer compliance means for your business. Learn how to classify, avoid risks, and stay compliant across global markets with this guide.

What is a Contingent Worker?

Learn what a contingent worker is and why they’re key to a flexible workforce. Explore the types, benefits, and management strategies for contingent talent

What is a Contractor Of Record (COR)?

Discover the role of a Contractor of Record (COR) – Learn how a COR streamlines contractor compliance and safeguards your business legally.

California’s Freelance Worker Protection Act: What Businesses Need to Know

Learn how California’s Freelance Worker Protection Act (FWPA) impacts your business with compliance requirements, payment rules, and penalties.

The Hidden Complexities of Independent Contractor Classification

Read the complexities of independent contractor classification in our guide. Stay ahead with expert insights into evolving rules, tools, and future trends.

What are Global Payroll Providers: Understanding Payroll Systems

Explore the essentials of international global payroll, how it supports multinational operations, compliance, and simplifies payroll global processing.