Contractor vs Freelancer: What’s The Difference?

- 1 Jul 2022

- 5 mins read

- Posted in

Updated on the 15th of September 2025

What is the difference between freelance and contractors workers?

A freelancer offers multi-project flexibility and independent service delivery across diverse clients and industries. In contrast, a contractor provides specialized expertise on a defined scope for a single company under a time-bound agreement.

Contents:

2. The 5 key differences between freelancers and contractors

There was a time when companies saw independent contractors and temporary workers as a backup plan; to cover for full-time employees on leave or to tide through periods of extra work. Today, you will be hard-pressed to find an organisation that does not employ external workers in some capacity or the other. In a recent article, SAP Fieldglass found that only 58% of workforce spend is on employees. The other 42% of workforce spend is on external labor.

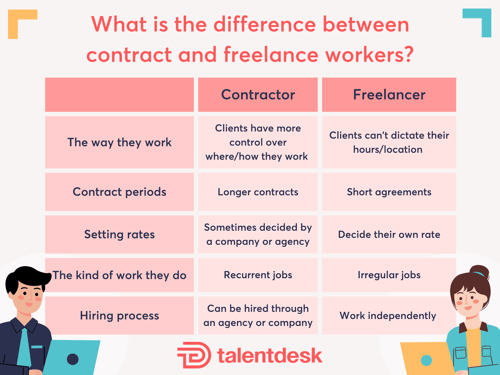

However, such widespread inclusion of external workers is still comparatively new, and many managers are not well versed with the associated terminology between freelance vs contract workers. The main differences between contract and freelance workers are that contractors typically work for a single client who has control over where and how they work and are provided with recurrent jobs, while freelancers work on multiple projects on their own and their hours or location can’t be dictated. In this article we help differentiate freelance vs contractor further, and we discuss how these workers are commonly confused with one another.

Contractors vs Freelancers

-

What is a freelancer?

Freelance workers are self-employed individuals, setting their own rates, who are not affiliated to any company or an agency. They operate largely on their own, developing, marketing and offering specialised skills and services to multiple clients. Think freelance graphic designers or photographers whose skills are required for just a day, or a designer who is tasked to create a single presentation for a company.

-

What is an independent contractor?

A freelance contractor on the other hand typically do freelance contract work as an external employee who may or may not be self-employed doing contract work. In the traditional sense of the word, an independent contractor is actually employed by a vendor or an agency. They report to managers at these agencies and receive regular payments from them too. In a more modern context however, the term may refer to an independent contractor. These are highly skilled professionals who provide niche expert services, own their own companies, and work for themselves rather than for an agency. Think an M&A Project Manager, customer service support, or IT infrastructure support.

Given that the level of autonomy that independent contractors enjoy is quite similar to a freelancer, many managers confuse freelance and contract workers and use the terms interchangeably. This leads to all sorts of confusion when it comes to setting expectations, establishing terms and conditions, buying the right management tools, and filing taxes. So how can you tell the difference between contract and freelance workers?

Are you finding it hard to classify your workers as freelance or contract vs employees? Take our free quiz to figure out the differences between freelancer and contractor.

The 5 Key Differences Between Freelancers and Contractors

‹

‹

-

The hiring process

When it comes to freelance vs contract, how you hire an external worker can tell you whether they are freelancer vs contractor workers. For example, if your company wants to outsource a certain job, you may reach out to an external vendor or agency. This vendor then assigns a number of workers to perform the task at hand. These workers are termed as contractors. At the end of the month, you pay the vendor, who in turn, pays each individual contractor. Do note that in the case of an independent contractor, however, the hiring process may be more direct. Since they own their own limited company, you would be dealing with the individual directly, rather than liaising with an agency.

Freelancers on the other hand, always typically work on their own. Freelancers are self employed and as an employer, you reach out to them directly, you do not have to go via an agency or a vendor to hire a freelancer. Payments are made directly too. Once the task is completed, you pay the freelancer the full amount that was agreed upon.

-

Contract periods

Contract workers and independent contractors are hired for periods that typically, span over a long duration — say 3 months to a year, maybe even longer. The engagement usually is more intensive too, contractors normally devote all their work hours to a single client for the entire duration of the contract.

In contrast, freelancer agreements are usually much shorter. Many companies hire freelancers for a single project, or even for a one day requirement. The agreement does not take up all of the freelancer’s working hours during the contract period either, the freelancer may simply need to devote a few hours every week to a single client. Given the quick, short nature of their engagements, a freelancer usually works with multiple employers at a time.

-

The way they typically work

As an employer, you have more say over how a contractor works. Depending on the task that you hired them for, you may need a contractor to work on-site or use your company’s facilities. The job may require them to work certain set hours, so they may not be free to choose their own timings either. Take for instance, contractors who are hired to provide customer support services. These professionals will need to be available when the company’s support hotlines are open. Likewise, an independent contractor you hire to provide system backup and maintenance services may need to work during the hours when the rest of the team is offline. These timing requirements are stipulated in their contracts.

How to differentiate between 1099 and W-2 workers (and why you should get this right).

Unlike a contractor, an employer cannot dictate when, where and how a freelancer works. Freelancers can set their own timings and plan their own work days, as long as they complete the deliverables by the agreed upon deadline. They might want to work from home, cafés or coworking spaces, rather than operating out of the employers’ offices. It is also their own responsibility to ensure that they take care of their own taxes and have all the right equipment and licences required to do the job they are hired for.

-

The kind of work they do

Though this is not definitive, the jobs that contractors do tend to be different from the kind of tasks that freelancers take on. Many companies outsource regular, recurrent jobs to contractors. These may include tasks like analysing data, providing security services, performing repairs or even managing teams. Companies like Google have a massive contract workforce for crucial tasks that need to be performed at regular intervals — coding, screening content, conducting demos and handling calls. It is also very common for companies to hire skilled independent contractors for IT services like performing software updates, system maintenance, and data protection.

Given that freelancers’ timings, location and other work specifications cannot be dictated by employers, they are usually hired for non-recurrent, irregular jobs. Freelancers are extremely common in the marketing, media and creative industries. Graphic designers, content writers, marketing managers, UX/UI designers and strategists often work on a freelance work from home basis, offering their skills to a number of clients.

-

Setting rates

Freelancers are expected to set their own rates. They can decide whether they prefer being charged by the hour, by the day, or by the project. They are also responsible of negotiating rates with their clients, requesting payments, and managing their invoices.

The situation is quite different for contractors, who are generally hired through an agency. It is the agency's job to come up with a rate and to communicate it with the client. However, some contractors are independent and are, just like freelancers, responsible of setting their own rates and handling their invoicing independently.

Whether you employ independent contractors or freelancers, what matters at the end of the day is that you are able to get the best out of your external workforce. Contractors vs freelancers - being able to tell the difference between freelancer and contractor workers will only enable you to set the right expectations and brief them well.

Richa Dayal

Speak to us to find out how we can help you pay your contractors more efficiently

Related articles

Compliance in Vendor Management

Ensure safe vendor partnerships with a third-party compliance strategy. Learn key regulations, audit steps and how TalentDesk simplifies vendor management.

Vendor Risk Management – How to Identify & Control Third-Party Risks

Proactive Vendor Risk Management is key to preventing compliance & financial issues. Learn how to assess, score and mitigate vendor risks effectively.

Freelancer Management System (FMS) vs Vendor Management System (VMS)

Discover the differences between freelancers and vendors, when to use FMS or VMS, and how an integrated approach like TalentDesk helps manage both easily.

Contract Management in Vendor Relationships

Learn how to manage vendor contracts effectively, from key clauses and negotiation tips to lifecycle best practices that reduce risk and boost performance.

10 Best Freelancer Management Software (FMS) Tools to Consider in 2025

Explore top 10 Freelancer Management Software tools to consider in 2025. Centralize hiring, streamline onboarding, compliance & simplify global payments

Understanding the ABC Test in Worker Classification

Navigate the complexities of worker classification with an understanding of the ABC Test. Explore its legal, financial, and compliance implications.

Integrating Accounting Systems with Freelancer Platforms

Read how integrating freelancer platforms with accounting systems transforms your operations. Streamline payments, compliance & gain real-time visibility.

What is Freelancer Compliance? A Complete Guide for Businesses

Discover what freelancer compliance means for your business. Learn how to classify, avoid risks, and stay compliant across global markets with this guide.

What is Vendor Management and how does it help?

Discover how vendor management can improve cost-efficiency, reduce risk, and support innovation. Learn about lifecycle stages, best practices & challenges.

What is a Contingent Worker?

Learn what a contingent worker is and why they’re key to a flexible workforce. Explore the types, benefits, and management strategies for contingent talent